Turning value into profit: the lever for sustainable profitability

“Nowadays people know the price of everything and the value of nothing.” (Oscar Wilde)

In the early 1960s, the United States was young, confident, and in love with sports cars. Many of the songs released during those years were dedicated to the world of automobiles—for instance, 1965 saw the release of the Beatles’ “Drive My Car“, the opening track of their albums “Rubber Soul” and “Yesterday and Today”.

Unfortunately for the Ford Motor Company, the cars sparking the most passion among consumers were not theirs. Determined to ride this market trend, Ford’s management began developing a sports car model designed to entice potential customers into their showrooms.

Had they followed the traditional development approach, Ford’s management would most likely have hired a design department, tasking them with creating a sports car to match the competitors’ models. Within a couple of weeks, the designers would have presented several potential concepts to management. Once the most promising designs were selected, they would have turned to the marketing department to investigate which one potential customers preferred over the competition, always in relation to a price point that could cover Ford’s fixed costs and achieve the desired return on investment (ROI).

The model “chosen” by potential customers would then have been industrialized, built, and displayed in showrooms, where it certainly would have earned the admiration of many… but likely the purchase of only a few!

The Ford Challenge

Fortunately for Ford, things took a different turn: the product development process did not start in the design department. Instead, the company began to investigate what consumers actually wanted and looked for in a sports car.

They discovered a large and growing market segment that desired a sports car but could not afford one. Furthermore, they found that most consumers in this segment were not looking for high-performance engineering—which would have required massive development costs for the engine, suspension, and transmission—but rather the “sports car experience“: the styling, the interior design, vinyl trims, and the trendy wheels of the era.

None of Ford’s competitors were marketing a sports car experience at an affordable price point: under $2,500 at the time.

Ford’s challenge, therefore, was to design and build a car that conveyed the sporty values sought by potential customers without the prohibitive development costs of traditional mechanical components, which would have pushed the final price out of reach and eroded the expected margins.

The puzzle was solved by building what would become the Mustang using the mechanical underpinnings of the Falcon, an existing economy model in Ford’s portfolio.

While the new model by no means matched the technical performance of other sports cars on the market, it was exactly what most consumers were looking for, at a price they could afford.

In April 1964, Ford introduced the Mustang with a list price of $2,368. In its first two years of sales, the Mustang generated $1.1 billion in net profits for the company.

Strategic Pricing in Practice

Starting with the customers and investigating what they were looking for and at what price: this is how Ford gathered the insights needed to decide the market price for its new sports car. Only then did the development of the Mustang begin, ensuring it met consumer expectations and price points while simultaneously generating substantial profits.

Of course, Ford never lost sight of costs. In the pricing strategy tied to the car’s development, costs played a vital role in defining how the product was engineered, determining which features the Mustang would include and which it would not.

While potential customers could not afford a traditional sports car, at the price of $2,368, the Mustang offered exactly what held the most value for them.

Ford’s methodological approach, specifically its decisions regarding price and features, is a textbook example of Applied Strategic Pricing. The goal of this approach is sustainable profitability: identifying only the features that must be included because customers are willing to pay for them, while eliminating those that disproportionately increase costs relative to the value recognized by the customer.

This approach requires translating the company’s differentiating benefits into a perceived premium price that customers are willing to pay. It demands the ability to vary pricing to optimally absorb fixed costs and to discourage customer behaviors that might excessively drive up the cost to serve them.

A value-based approach

A fundamental pillar of an effective and efficient pricing strategy is the Value-based approach. This method involves setting different prices for products or services that deliver different levels of value to customers, a concept perfectly embodied by Ford and the Mustang case study.

To illustrate how this approach works, we might ask: during a market downturn, is it necessary to lower prices to sustain demand? The value-based answer is clear: if your products deliver less value to customers during a recession, then prices should reflect that shift. However, the mere fact that there are fewer potential customers in the market does not necessarily mean that those remaining value the products any less.

Unless a competitor has cut their prices or is offering a superior alternative to your own, from a value-based perspective, there is no reason to lower prices during a recessionary period.

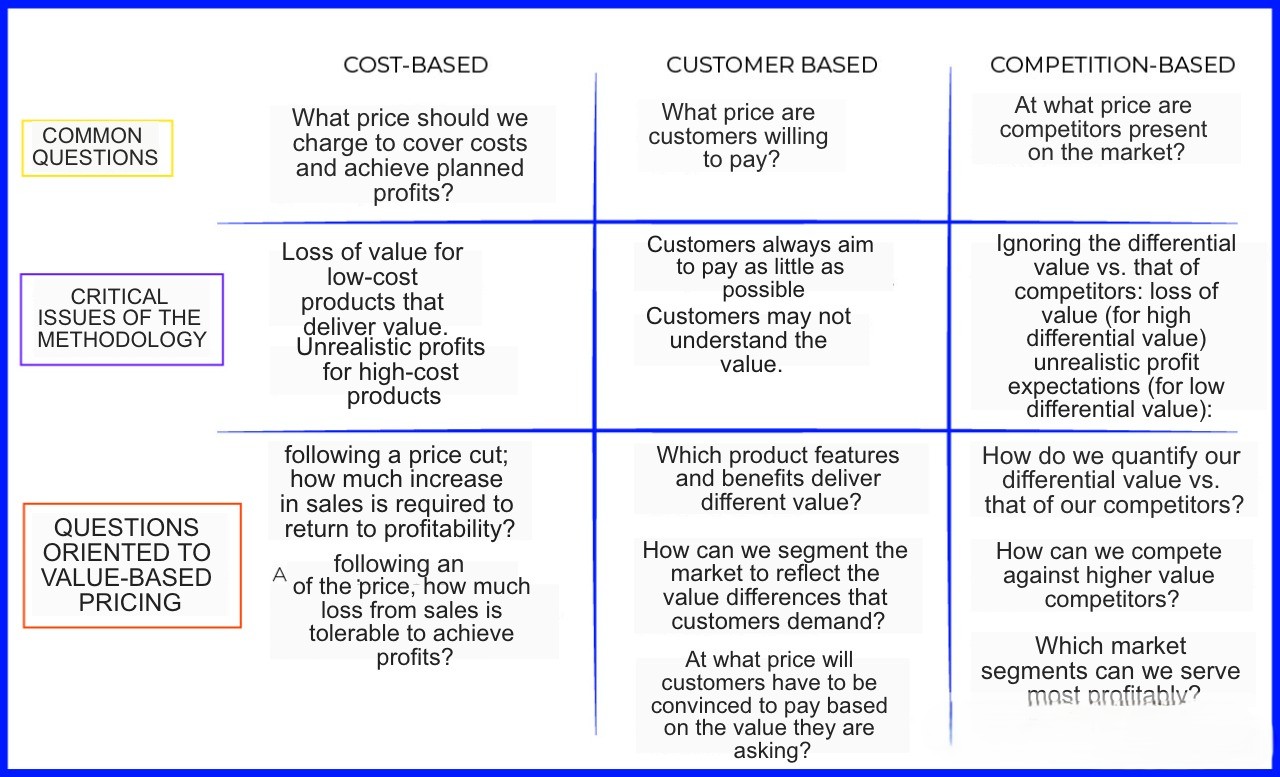

The value-based approach differs from traditional pricing methods commonly found in the market, namely Cost-based, Customer-based, and Competition-based, and resolves their inherent flaws.

Looking back at Ford’s methodology, we can identify four key stages of applying value-based pricing:

- Value Assessment – What specific value does our solution provide to different customer segments?

- Offer & Pricing Configuration – How should we structure our offer and pricing model to maximize profitability?

- Price Setting – How do we calibrate price levels to strike the optimal balance between margins and volumes?

- Value Communication – How can we shape and influence the perception of value through strategic communication?

The guiding question behind this approach is: What is the best value we can offer to our consumers? By answering this question first, we arrive at the Target Selling Price (the one applied by Ford), which is based on an estimate of customer value rather than the costs incurred to develop the product.

It is the Target Selling Price that drives decisions regarding which costs to actually incur, not the other way around.

The key to creating customer value, and therefore sustainable profitability for the company is to understand how much value different combinations of features and benefits represent for consumers and building diverse offerings accordingly.

Companies that effectively and efficiently implement this strategy can gain massive market advantages, making their business significantly more sustainable and profitable.

Articolo a cura di:

Riccardo Siciliani

former Manager Lenovys

He is a Manager in the Delivery Unit Strategy & Innovation at Lenovys, and manages projects related to the definition and implementation of corporate strategies, the innovation systems and application of Lean Product and Process Development principles with clients operating in the manufacturing, food & beverage and financial services sectors.

Read more