Acquisitions and strategy: an essential union

The whole is greater than the sum of its parts.

(Aristotle, Metaphysics)

Acquisition (or merger) with other companies has always been a strategic lever operated by firms to pursue different growth objectives.

Whether to expand into new markets (national or international), acquire new customers, or increase the offering of its product / service portfolio, the strategy and underlying motivations that motivate any merger and acquisition (M&A) transaction must be closely linked to the company’s overall –long- and short-term– strategy, otherwise the transaction itself will fail.

Unfortunately, not all merger and acquisition transactions achieve the desired results: by cross-referencing several reports on the topic produced by investment banks and private equity funds, we can estimate that, on average, the success rate of transactions executed in a year stands at around 27%, very low percentage when weighed against the importance in terms of the commitment of resources (financial and otherwise) that companies commit when they begin an acquisition and/or merger process.

Achieving growth targets: the key obstacles

Among the key obstacles that prevent the achievement of growth objectives through these operations we can include:

- Lack of focus on understanding how the merger and acquisition transaction will deliver greater value to the customers of the newly formed company;

- Inadequate planning and hasty decisions in the process of integrating the operations of the two companies involved in the operation;

- Emphasis on achieving cost synergies only;

- Conflicting aspirations between the management classes of the two companies;

- Operating models and business processes not suitable for the new company;

- Failure to achieve commercial “quick wins” linked to the growth objectives set along the integration process between the two companies.

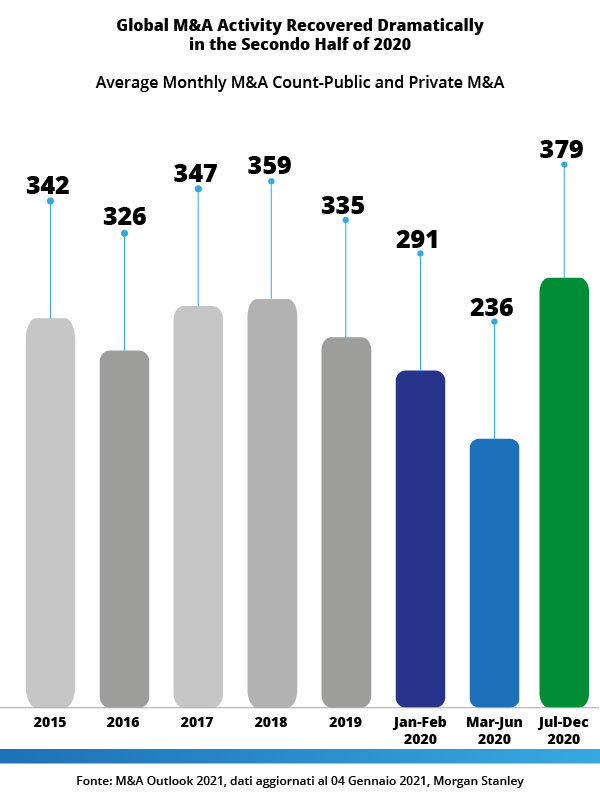

Certainly, the past pandemic period has brought a setback in the number of merger and acquisition transactions, as investment bank Morgan Stanley illustrates in the chart shown here.

And it is also true that already in the second half of 2020 we recorded an increase in merger and acquisition operations and throughout 2021 the growth trend is expected to be strongly positive for several reasons:

- Access to capital market facilitated by low supply costs;

- “Rebound effect” in the sectors most affected by the pandemic;

- Need to digitize your own business, a necessity that brings the acquisition of technology start-ups into the crosshairs of many companies.

Drawing a standard M&A process

It is therefore of strategic importance to create a true internal operational guide within the company that is synergistically linked to the strategy design and execution process.

The key benefits companies can achieve by developing their own M&A process:

- build the internal skills necessary for the autonomous identification and prioritization of those targets that can have the greatest impact on the relative competitive position that the company has in the industrial sector/ markets in which it operates, exploiting the skills that the same company has (or will build with the acquisition) to win in that industrial sector / markets;

- increase the ability to perform acquisition and integration, consequently bringing greater synergistic benefits;

- develop the ability not to rely, in building the pipeline of target companies to be acquired, solely on auctions or inputs from merchant banks.

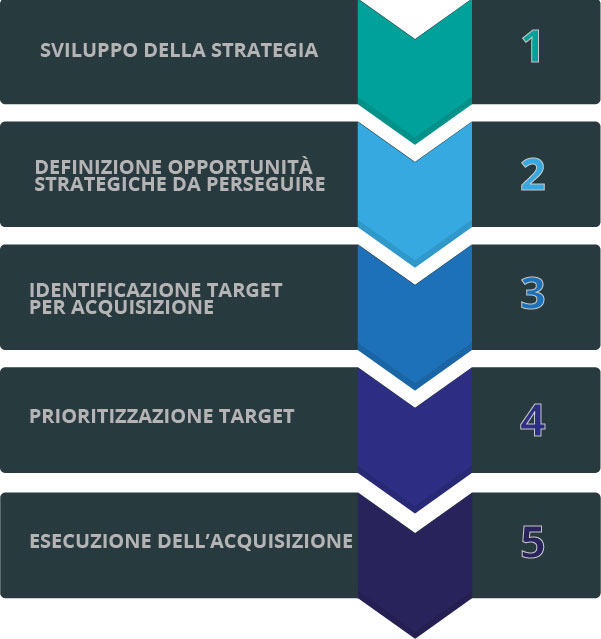

Considering the peculiarity of each company, we can in any case design a standard process that synergizes the company’s strategy with the objectives of Mergers and Acquisitions, and highlight the “blind spots”, the critical issues to pay attention to during execution.

A general element to be aware of for its negative influence on the effectiveness of the entire process –and which we have observed multiple times – is to keep the focus on the objectives of the merger and acquisition operations only at the stage of “Target identification” (point 3) of the process set out above: in doing so, it is natural that any acquisition or integration initiative could lead to failure, because the strategic reasoning that motivates the search for a target company has been skipped over. Following this modus operandi, the enormous danger is deciding on a business growth path regardless of whether it is possible to activate a merger or acquisition path, delaying the development of the reason for the extraordinary transaction along with the “more tactical” activities of target research and acquisition execution.

On the contrary, it is from the stage of “Strategy Development” and in “Definition of Strategic Opportunities”, – in summary in answering the two key questions “Where to play?” (What market segments do we want to play in?) and “How to Win?” (what is our value proposition and how we differentiate ourselves from the competition) and in developing the strategic projects that will achieve the defined strategy and opportunities – that management must ask itself whether there are acquisition possibilities, analyzing long- and short-term growth objectives.

It is necessary to reflect in depth on the strategy and the projects that will make it operational, seeking to:

- Validate existing growth opportunities in current and potential markets and customer segments;

- Appropriately size the “new company” potentially resulting from the acquisition or merger, terms of turnover acquired from the operation and potential;

- Define the value proposition, product portfolio and related pricing, optimize the channel mix and messages that could potentially be created by the new company to achieve a unified “go-to-market”;

- Understand how to improve the customer experience in the “new company” to numerically increase purchasing decisions.

Only after analyzing and validating these three macro-aspects – Growth Opportunities, Go-To-Market and Customer Experience – in synergy and considering the totality of the company’s strategic path can we be sure that the strategic projects that will have as their object the acquisition or integration of a company – and that will follow the other three points of the process (Identification and prioritization of the target, Execution of the deal) – have a high probability of achieving the desired results.

Merger and acquisition (M&A) can be a potentially disruptive tool for increasing market share, diversifying business model risk, or acquiring new skills. However, to unlock its full potential, it must be considered and analyzed holistically at Strategy Deployment, the model for defining and synthesizing, linking them together with corporate strategy, tactical objectives, projects, operational processes, and placed at the service of the company’s growth from a perspective that synergistically considers all aspects of strategic planning.

Articolo a cura di:

Riccardo Siciliani

former Manager Lenovys

He is a Manager in the Delivery Unit Strategy & Innovation at Lenovys, and manages projects related to the definition and implementation of corporate strategies, the innovation systems and application of Lean Product and Process Development principles with clients operating in the manufacturing, food & beverage and financial services sectors.

Read more